The Power of a Single Corporate Relief Fund Compared to Multiple Division or Geographical Programs

November 27, 2023

Why Making an End-of-Year Checklist Is So Important (Especially for Relief Funds)

December 19, 2023November 30, 2023

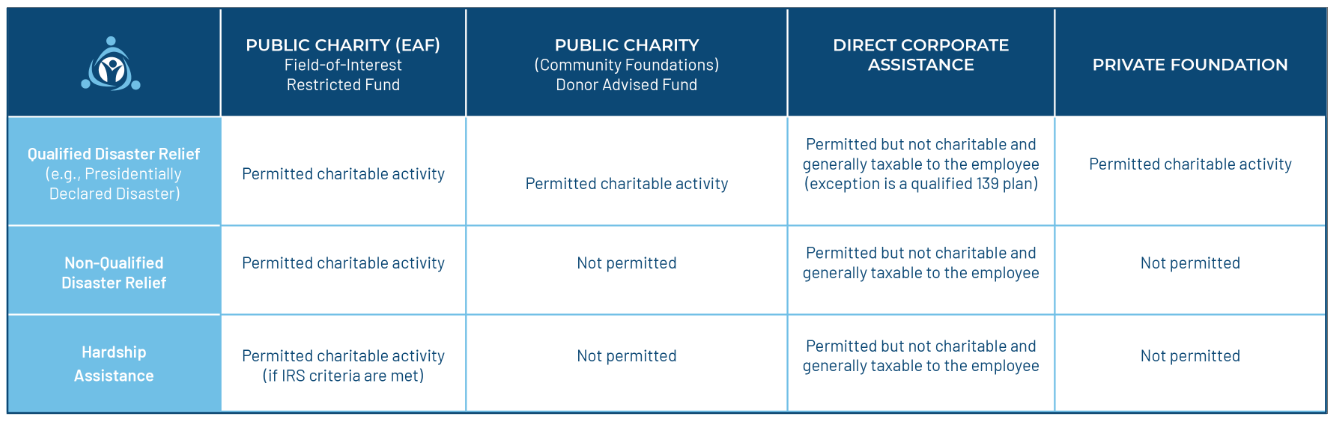

The IRS recently released the first installment of long-awaited Donor Advised Fund regulations that have sparked a renewed focus on the strategic structuring of charitable giving on November 13, 2023. The IRS ruling on Donor Advised Funds (DAFs) has shown the necessity of Field-of-Interest Restricted Funds when providing relief for non-qualified disasters and personal hardships.

The Proposed Regulations (REG-142338-07) state that “disaster relief funds (within and outside of the employment context) are not DAFs, provided they comply with the tax code requirements that govern the provision of relief payments to employees to assist during qualified disasters. The Proposed Regulations decline to extend the DAF exception to emergency hardship funds outside the context of qualified disasters.”

Public charities administering Field-of-Interest Restricted Funds, like Emergency Assistance Foundation, are permitted to provide tax-advantaged relief for qualified disasters, non-qualified disasters, and hardships. This is not the case for the other charitable structures outlined below.

The recent IRS Donor Advised Fund Regulations serve as a reminder of the importance of thoughtful and strategic charitable giving. Field-of-Interest Restricted Funds provide a valuable alternative, allowing donors to contribute meaningfully to relief efforts not only for qualified disasters, but also for non-qualified disasters and personal hardships.

Learn more about relief fund compliance here. If your organization is interested in establishing a relief fund or ensuring a current fund’s compliance, consider scheduling a meeting with Emergency Assistance Foundation.

Author: Doug Stockham, President

Emergency Assistance Foundation